Q&A on higher buyback rates for electricity from renewables

As part of the Homegrown Renewable Energy Campaign RENEW prepared A Primer on Renewable Energy Producer Payments (REPP’s) in a question and answer format:

Q. What are Renewable Energy Producer Payments (REPP’s)?

A. Renewable Energy Production Payments are premium utility buyback rates designed to encourage customer-owned or third-party-owned installations of small-scale electric generators powered by renewable energy sources as solar, wind, biogas, hydro and biomass. In many jurisdictions where this mechanism has been adopted, REPP’s are better known as feed-in tariffs.

Successfully used in Europe, REPP’s can support a large market for renewable energy and limit the impact on ratepayers by spreading costs to all electricity customers. Where established, REPP’s have fostered extraordinary growth in renewable energy and remarkably high local ownership rates for projects: 45% local ownership of German wind energy projects and 83% of Danish wind installations. In addition, REPP’s have supported a greater diversity of energy sources, such as solar photovoltaics and biogas systems.

Q. Can REPP’s work in tandem with Wisconsin’s Renewable Energy Standard?

A. A statewide system of REPP’s could complement Wisconsin’s Renewable Energy Standard by stimulating investment in distributed renewable energy installations, making non-wind generation economical, and fostering local ownership of projects. With premium prices available to anyone, REPP’s are the preeminent policy tool for turning electricity customers into renewable energy producers.

Q. Why provide advantages to distributed renewable generation?

A. Increasing production of in-state distributed renewable energy will result in the following benefits to utilities and their customers:

+ Enhanced ability to manage fossil fuel price volatility and supply constraints;

+ Reduced exposure to downstream costs from new regulations aimed at reducing carbon emissions;

+ Increased likelihood of lower portfolio generation costs through the long-term use of low- or zero-cost fuels;

+ Cost reductions in photovoltaic, wind, and biogas technologies due to increased market stability and resulting technological and cost improvements; and

+ Increased potential for strengthening local distribution systems without expensive traditional upgrades to utility distribution grids.

Increasing production of in-state distributed renewable energy will result in the following benefits to the State of Wisconsin:

+ Fewer dollars flowing out of state to purchase energy from out-of-state sources (including bulk renewable generation), thereby reducing the state’s dependence on imported energy, the Achilles heel of Wisconsin’s economy;

+ Job growth and expanded business opportunities for Wisconsin farmers and renewable energy equipment manufacturers and installation contractors;

+ Less pollution (cleaner air, enhanced groundwater protection).

Q. Where have REPP’s been adopted?

A. Over 40 nations, states and provinces around the world have adopted REPP’s, including such European nations as Germany, Spain, Portugal, Denmark, France, Italy, Greece, Czech Republic and Austria. The most recent addition to that list is the United Kingdom. As part of the Energy Bill enacted in November 2008, the British government must institute by 2010 a system of REPP’s for small renewable energy producers.

On our side of the Atlantic Ocean, there is increasing evidence that the stiff resistance that once characterized North American attitudes to REPP’s is eroding. The Province of Ontario was the first government on this continent to adopt REPP’s that are available to all participants. In November 2008 Los Angeles Department of Water and Power, the largest municipal utility in the United States, has announced plans to institute a solar buyback rate to bring on-line 150 MW of customer-owned solar electric capacity.

Q. Which renewable energy sources would qualify for REPP’s?

A. Eligible resources would be the same as those that electric utilities presently use to satisfy their renewable energy requirements. As specified in 196.378(b), eligible resources include: (1) solar; (2) wind; (3) hydro; (4) biogas derived from landfills, livestock operations, wastewater treatment plants and food processors; (5) biomass (woody crops and residues, agricultural crops and residues); and (6) hydrogen derived from a resource listed above.

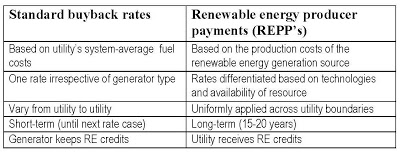

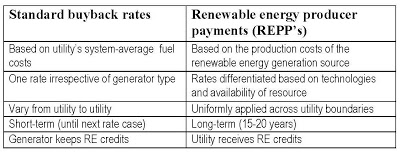

Q. How do REPP’s differ from standard utility buyback rates?

A. Standard buyback rates reflect the systemwide average fuel cost of a particular utility. The formula used to determine a standard buyback rate combines the cost of fueling baseload power plants (typically with coal) with the cost of fueling peaking plants (typically with natural gas). Standard buyback rates are fuel-neutral; that is, they don’t change based on the generator fuel being used. With each rate filing, the Public Service Commission reviews the utility’s avoided fuel costs and resets its buyback rates accordingly. Electricity acquired under a standard buyback rate does not increase base rates, but it will vary from one utility to another, based on the utility’s internal fuel costs.

In contrast, REPP’s fix a payment stream over a specified term based solely on the production costs of the renewable energy installation. Projecting a revenue stream over time is made possible when generation sources rely on zero-cost fuel sources like sunshine, wind, dairy cow manure and flowing water. Because REPP’s are completely unrelated to a utility’s internal fuel costs, they do not require adjustment with each rate filing. Within a particular fuel category and generator size, installation and operating costs will be similar irrespective of their location. Therefore, REPP’s have capability of being uniformly applied throughout Wisconsin.

The matrix below compares and contrasts key attributes of standard buyback rates and REPP’s.

Q. But doesn’t Wisconsin already have a renewable energy incentive program that is intended to stimulate distributed renewable energy generation?

A. Yes. Wisconsin’s ratepayer-funded public benefits program, called Focus on Energy, does offer incentives for customer-sited renewable energy systems. However, the quantity of funds available to support renewable generation is very modest. Focus on Energy’s 2009 budget envisions allocating $4.2 million in up-front incentives toward solar, wind (up to 100 kW only), and biogas electric systems. That allocation can’t be increased because the percentage of Focus on Energy dollars available for distributed renewable generation is fixed by law at 4.5%. Moreover, the program’s overall budget is capped at 1.2% of utility gross revenues, and cannot be reset without legislative approval.

At current funding levels, Focus on Energy cannot support more than seven modestly sized biogas generation projects in a given year. As for solar, next year’s budget should support between 180 and 200 systems statewide. As long as Focus on Energy incentives are relied upon to stimulate the distributed renewable energy market, funding limitations will surely impede this sector’s capacity for growth.

Moreover, to spread the awards to as many projects as possible, most Focus on Energy incentives are sized to offset no more than 25% of system installation costs. That is a very modest level of support compared with other renewable energy programs around the country. The prospective system owner has to line up other external sources of funding, such as federal tax credits, U.S.D.A awards and higher buyback rates, to supplement the Focus on Energy award. Under the current system, it takes a certain level of heroic effort—and tolerance for paperwork—to secure a bank loan for a renewable energy installation.

Q. How would REPP’s improve upon the present arrangements for selling renewable electricity to utilities?

In general, the combination of standard buyback rates and Focus on Energy incentives does not generate sufficient revenue flow to make investments in distributed renewable energy worthwhile. Because they are structured to ensure full cost recovery of the investment as long as their renewable energy system is operating, REPP’s are more appealing to investors and lenders than up-front incentives. From the standpoint of both utilities and generators, REPP’s are easy and inexpensive to administer over their term. They are also transparent and open for inspection, unlike Power Purchase Agreements, which usually occasion the signing of confidentiality agreements to prevent cost information from entering into the public domain. REPP’s help renewable energy generators avoid the hassle of negotiating Power Purchase Agreements with utilities, which is often an opaque, time-consuming and lawyer-intensive process.

Q. Is legislation required to establish REPP’s in Wisconsin?

A. The Public Service Commission of Wisconsin (PSCW) regulates all electric providers except rural electric cooperatives and small municipal utilities. Its regulatory authority includes the ability to set rates for non-wholesale electricity purchases. Under current law, the agency has all the requisite authority to, through its own volition, convene a generic proceeding to investigate and establish REPP’s.

However, it may be desirable to adopt legislation directing the Commission to convene such a proceeding and establish a statewide program of REPP’s by a date certain. A bill of this nature could also provide guidance to the Commission in defining REPP’s and setting program boundaries. Among the threshold questions the legislation could address is (1) qualifying system size; (2) setting term lengths and allowable rates of return; and (3) penetration ceilings. An appropriate model for this legislation would be the budget amendment drafted by Rep. Dan Schooff in 2001that led to the revision of Wisconsin’s interconnection standards for distributed generation units, now encoded as PSC Chapter 119.

Q. How would the PSCW go about establish REPP’s?

A. Whether through its own initiative or in response to legislation, the Commission would convene a docket for the explicit purpose of revising and standardizing utility buyback rates to stimulate in-state renewable energy generation. The PSCW already has an abundant supply of material on the record in previous rate cases that could provide some guidance for this proceeding. Moreover, by virtue of its oversight authority over Focus on Energy, the Commission has ready access to up-to-date production cost information on various renewable energy technologies supported through that program. The wealth of cost and performance data accumulated during the renewable energy program’s six-plus years of operation will be immensely helpful when the PSCW reaches the rate-setting phase of this docket.

As was done for the interconnection standards proceeding, the PSCW should form a technical advisory committee to flesh out the details of a statewide system of production cost-based buyback rates. This group should be composed of renewable energy contractors and installers, utility rates and renewable program managers, Focus on Energy technical leads, other state agency staff, clean energy advocates and representatives of agricultural associations, electric customer groups, and local governments. Many of the organizations that were represented in the technical committee advising the PSCW on interconnection standards would likely take part in a similar body created for this proceeding.

Q. What issues should the Commission consider in this docket?

A. At a minimum, the following issues should receive consideration during the investigation phase of this docket?

(1) How much additional renewable energy could be captured through REPP’s statewide?

(2) Should there be a ceiling on the amount of renewable energy acquired through REPP’s and, if so, at what level?

(3) Should there be capacity limitations on the individual installations and, if so, at what level?

(4) What is the appropriate duration of a REPP?

(5) In calculating production costs, how much return on investment is reasonable?

(5) Should any boundaries or limitations be placed on the acquisition of any particular energy resource through REPP’s?

(6) How frequently should tariffs be reset to capture increased production efficiencies or lower capital costs?

(7) Is it reasonable to establish different tariffs in a given renewable resource, based on such characteristics as capacity size and resource availability?

(8) What is the appropriate rate treatment for a renewable generation source once the contract term expires?

(9) After the tariff term expires, should utilities continue to receive the associated renewable energy credits?

Q. Are there any examples right now of REPP’s in Wisconsin?

A. Even though some utilities now offer fixed-rate, technology-specific buyback rates for qualifying renewable energy systems, they do not meet the definition of REPP’s. Consider the example of Madison Gas & Electric’s 25 cents/kWh solar buyback rate, which a system owner can lock into for 10 years. On the plus side, this offering is twice MGE’s retail electric rate. However, it does not qualify as a true REPP, because the revenue stream it generates falls well short of what’s needed to achieve a reasonable return on most installations, even in cases where the system owners can take full advantage of federal tax credits and accelerated depreciation. Unless they are increased to match actual production costs and a reasonable return on investment, the current crop of special buyback rates will have only a modest effect on installation activity.

Q. Can REPP’s be designed to work with federal incentives work?

A. As it relates to solar, yes. Federal policy provides for a 30% investment tax credit (ITC) for solar electric systems, irrespective of size. Unlike the production tax credits for wind and biogas, the solar ITC does not distinguish between individuals and businesses. All taxpayers can take advantage of the credit, which will remain in effect through 2016. Given the lengthy duration of this federal incentive, it makes sense for states and utilities to account for this federal incentive when they estimate the production costs of PV installations in their territory. (A caveat: nonprofit customers and government entities are not eligible for federal tax credits. This disadvantage could be overcome with additional up-front installation incentives, like the kind We Energies provides to spur nonprofit ownership of renewable energy systems.)

Unlike the solar ITC, the renewable energy production tax credit (PTC), the principal federal mechanism for stimulating wind and biogas installations, is designed to reward highly profitable companies that have large tax appetites. Companies that don’t have large tax liabilities or are not yet turning a profit are unable to take advantage of this mechanism. The alternative minimum tax can also negate the impact of the renewable energy PTC. For that reason, REPP’s for wind and biogas should not be adjusted to account for the PTC.

Q. If REPP’s were established, would utilities be able to apply the electricity they purchased toward their renewable energy requirements under 2005 Act 141?

A. Yes they would. In a recent ruling, the Federal Energy Regulatory Commission took the view that renewable energy credits created by a renewable energy generation source are the property of the generator unless specifically conveyed to the purchaser. If REPP’s are adopted in Wisconsin, their contract terms should specify that all renewable energy attributes associated with the electricity generated are also conveyed to the utility purchaser. That way, utilities would be able to use the electricity acquired through REPP’s to satisfy current and future renewable energy requirements.

Q. How effective are REPP’s at creating jobs and business opportunities in Germany?

A. In the 17 years since it established REPP’s, Germany has become the world’s leading producer of renewable energy technology. German investments in solar electric systems now total US$5 billion, and nearly 35,000 are employed in its rapidly growing solar industry. German heavy industry employs 70,000 in the wind energy sector. In 2007 investments in new wind turbines totaled more than US$4.5 billion. Across all renewable energy technology sectors, direct and indirect employment in the German renewable energy industry reached 214,000 in 2006, according to a recent study by Germany’s Ministry for the Environment (BMU). The study also found that the industry’s total turnover neared €22 billion. These jobs increased 40% between 2004 and 2006 alone. Most of these new jobs are in the former East Germany, an area being revitalized by their renewable energy economy. All levels of jobs are created including high-skilled positions in engineering, manufacturing, agriculture, and electronics.

Q. How effective have REPP’s been in stimulating renewable energy installations in Germany?

A. German renewable energy sources supplied 5.3% of primary energy in Germany and 11.8% of electricity in 2006. The breakdown is as follows:

Wind – Germany continues to lead all other nations in wind generating capacity. Current installed capacity is about 23,300 MW, according to data from WindPower Monthly. A country the size of Montana, Germany operates 1.2 times more wind generating capacity than that of the entire lower 48 states. Germany currently provides about 7% of its electricity from wind energy alone

Photovoltaics – Strong demand for solar cells from German farmers and homeowners resulted in another record year for the installation of solar photovoltaic systems in the country, according to data compiled by the German Solar Energy Association). Germany installed an astounding 100,000 solar systems in 2006, representing 750 MW of solar-electric generation. This follows on the back-to-back record-setting years of 2005 (750 MW), and 2004 (600 MW). Germany now operates more solar-electric generating capacity (2,500 MW) than the installed wind-generating capacity of Britain, Italy, France, or the Netherlands. Analysts estimate that solar cells in Germany now generate about 2 TWh of electricity per year, or nearly one-half of one percent of German electricity consumption.

Biogas – Germany employs 8,000 in the on-farm biogas industry. Manure-fired power plants generate nearly five billion kilowatt-hours per year of electricity, or about one percent of consumption, says the German Renewable Energy Association). Biogas is mostly methane, a powerful greenhouse gas that would otherwise be emitted to the atmosphere from dairies and pig farms.

Q. Where can I go on-line to learn more about REPP’s?

A. The following web sites are recommended as information sources:

Paul Gipe’s home page – http://www.wind-works.org/articles/feed_laws.html

Alliance for Renewable Energy – http://www.allianceforrenewableenergy.org

Institute for Local Self-Reliance – http://www.newrules.org/de/feed-in-tariffs.pdf

Prepared by RENEW Wisconsin, December 2008

Contact: Michael Vickerman

608.255.4044

mvickerman@renewwisconsin.org

www.renewwisconsin.org