by jboullion | Mar 1, 2011 | Uncategorized

For immediate release:

March 1, 2011

More information

Michael Vickerman

Executive Director

608.255.4044

mvickerman@renewwisconsin.org

(Madison) – The wind industry in Wisconsin suffered a serious setback when a joint legislative panel voted to suspend the wind siting rule promulgated by the Public Service Commission (PSC) in December, according to RENEW Wisconsin, a statewide renewable energy advocacy group.

The five-to-two vote tracked along party lines, with all five votes to suspend coming from Republican members of the Joint Committee for Review of Administrative Rules (JCRAR).

Many companies involved in windpower supported the PSC’s rule as a workable compromise that would have created a stable and predictable permitting environment for all wind energy systems regulated by local governments. The rule, which was scheduled to take effect today, would have fulfilled the Legislature’s intent to create uniform siting regulations to replace what had become a restrictive hodgepodge of local requirements.

“The committee gave the state of Wisconsin a black eye that, in the view of the wind industry, will linger well into the future,” Vickerman said.

“The suspension rolls the wind permitting environment back to the dark days when wind project developers routinely faced arbitrary and ever-shifting local regulations – the kind of chaos that will hasten their departure from Wisconsin to more business-friendly states.”

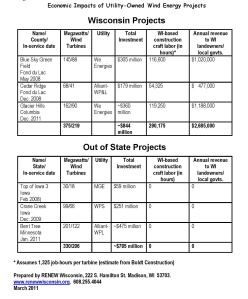

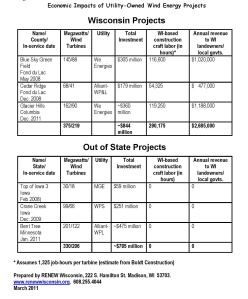

“As of today, Wisconsin utilities have placed more megawatts of wind capacity in neighboring states than in Wisconsin. As indicated in the following table, importing wind generation from other states deprives Wisconsin of a valuable source of employment, income for rural residents, and property tax relief,” said Vickerman.

The figures compiled by RENEW show that the 219 utility-owned wind turbines that will be operational by January 1, 2012, will yield nearly $2.7 million per year in potential property tax relief for towns and counties hosting wind projects. All told, these projects will be responsible for nearly 300,000 construction-related job-hours.

“We have a hard time foreseeing in-state utility-scale wind development going forward without statewide siting standards.”

“It’s a shame to see the end of bipartisanship that led to the passage of the rule requirement in 2009. What we are seeing here is a breakdown of governance that will rob the state of one of its brightest economic hopes for the future,” Vickerman said.

Click on table to enlarge.

RENEW Wisconsin is an independent, nonprofit 501(c)(3) organization that acts as a catalyst to advance a sustainable energy future through public policy and private sector initiatives. More information on RENEW’s Web site at www.renewwisconsin.org.

by jboullion | Jan 31, 2011 | Uncategorized

BEFORE THE

PUBLIC SERVICE COMMISSION OF WISCONSIN

Strategic Energy Assessment for the Years

January 1, 2010 through December 31

2016 Docket No. 05-ES-105

COMMENTS OF RENEW WISCONSIN ON THE DRAFT STRATEGIC ENERGY ASSESSMENT

_________________________________________________

RENEW Wisconsin submits these comments on the Commission’s draft Strategic Energy Assessment (SEA) 2016. RENEW’s comments focus on the “Electric Demand and Supply Conditions in Wisconsin” section.

The draft SEA notes that, in 2008, 67% of the energy produced in Wisconsin was generated by coal-fired power plants; 8% by natural gas; and 2% by biomass. Draft SEA, p. 18. Collectively, these units supplied 77% of the energy produced in Wisconsin. With the addition of the two new coal-fired generating units at the Elm Road Generation Station in 2010 and 2011, Wisconsin’s percentage of coal-fired generation has increased even more.

Fuel for all of these types of generating units comes at a cost, both the cost of the fuel itself and the cost to transport it to a generating station. Because coal makes up such a significant portion of the energy generated in Wisconsin and because it is not available in Wisconsin, its costs are particularly important. For years, the assumption has been that coal is cheap and abundant. Even the draft SEA notes that “Coal has historically been an abundant and inexpensive fuel for electric generation.” Draft SEA, p. 46. However, the ability to extract high quality coal and the cost to transport it to Wisconsin have been steadily increasing, calling into question the “abundant and cheap” mantra.

Most of the coal that fuels Wisconsin’s power plants comes from the Powder River Basin (PRB) in Wyoming. That region supplies coal to many of the largest coal plants in Wisconsin’s generating fleet–Columbia, Pleasant Prairie, Weston, Oak Creek, J.P. Madgett, Edgewater, and others. The contribution from other coal fields, such as those in the North Appalachian and Colorado regions, is small by comparison to the voluminous flow of low-sulfur subbituminous coal coming out of such mines as Black Thunder, Jacobs Ranch, Cordero Rojo, Antelope, and North Antelope Rochelle. The coal extracted from these mines is transported to power plants 1,000 miles away in Wisconsin on unit trains with as many as 130 cars.

Data from the Energy Information Administration (EIA) document the steadily rising cost of coal imported to Wisconsin over the past 10 years. In 1999, the average cost of coal delivered to Wisconsin electric utilities was $1.02/MMBtu (Table 34, Electric Power Monthly (EPM), March 2001). By 2004, the average cost had risen to $1.18/MMBtu (Table 4.10B, EPM, April 2005). The cost increase over the next five years was more pronounced, rising to $2.02/MMBtu (Table 4.10B, EPM, March 2010). The cost escalation between 1999 and 2009 corresponds to annual increases of 7%.

Increases in the cost of diesel fuel account for a significant portion of coal’s price rise. Spiking dramatically in mid-2008, diesel prices slumped 40% in 2009 but have since mid-2010 retraced a significant part of that decline, and are now comparable to where they were in early 2008.

Another driver behind rising coal prices is the increased cost of resource extraction. From 2000 to 2010, spot market prices of PRB coal rose from about $4 per ton to $14 per ton. Rising prices reflect increases in the “stripping ratio ,” a key measure of ore quality, encountered by mine operators. The stripping ratio indicates the number of tons of rock that must be moved to obtain a ton of coal. It is prudent to expect the stripping ratio of PBR coal to increase as the largest and most accessible mines become played out and mine operators shift to newer mines with deeper overburdens and thinner coal seams.

(http://www.cleanenergyaction.org/sites/default/files/Coal_Supply_Constraints_CEA_021209.pdf, p. 47.)

For example, the average overburden on the existing Antelope Mine is 122 feet thick and the coal seam is 86 feet thick. Antelope’s operator has applied to expand the coal mine to the west. While there is plenty of recoverable coal at Antelope II, it will be less productive than the original mine, because of the combination of thinner coal seams (50-60 feet thick) and average overburden depths (260 to 280 feet). Thus, the stripping ratio of Antelope II will be significantly higher, as will production costs.

(http://www.blm.gov/pgdata/content/wy/en/info/NEPA/documents/cfo/West_Antelope_II.html)

It’s worth pointing out that the U.S. coal market does not operate in isolation of overseas trends and events, which lately have been propelling coal costs higher. One well-reported trend is increasing demand from China, which has moved from an exporter to an importer of coal. The New York Times (NYT) reported in November 2009 that the volume of Chinese coal imports will hit all-time highs going into 2011. (http://www.nytimes.com/2010/11/30/business/energy-environment/30utilities.html?_r=1&scp=1&sq=breaking%20away%20from%20coal&st=cse)

The catastrophic flooding in northeast Australia earlier this month is certain to apply upward pressure on coal prices globally. Torrential rains incapacitated 75% of the operating coal mines in Queensland, the world’s largest coal-producing region. Much of the coal there is exported to other Asian markets. It will take many months if not years to dewater the mines and restore them to active operation. Though Queensland’s mines supply coking coal for the most part, the damage inflicted to the mines, roads, railways and bridges will ripple through the thermal coal markets as well and lift prices in that sector. (http://www.energydigital.com/sectors/mining-and-aggregates/queensland-flooding-washes-away-millions-coal-revenue

In addition, electric utilities have not been able to lock in low cost coal prices over long-term contracts. A review of recent coal shipments to Wisconsin power stations reveals that most supply contracts will expire between now and January 2013. (EIA-423 available at http://www.eia.doe.gov/cneaf/electricity/page/eia423.html)

The emergence of shorter-term contracts, coupled with the increasing tendency among Wisconsin utilities to rely on the spot market, increases the exposure of ratepayers to rising coal prices caused by (1) higher diesel fuel prices, (2) increased coal exports from North America to China, (3) the ongoing transition to lower-quality domestic coal sources, and (4) natural disasters and other perturbations in global supplies.

It should be noted that the current glut of generating capacity provides no insulation against rising fuel prices. The coal still has to be mined, loaded into unit cars, and transported across the Great Plains and the Mississippi River to reach Wisconsin generating units. Even if utility demand for coal diminishes incrementally during the planning period, whatever moderating effects that trend would induce are likely to be dwarfed by global factors, not least of which is Asia’s ravenous demand for coal, which domestic coal companies such as Peabody will be only too happy to feed.

With these challenges looming in plain sight, it will take a minor miracle to keep coal prices from rising above the 7% annualized rate of the previous 10 years.

Given the degree to which Wisconsin utilities are reliant on PBR coal supplies, RENEW recommends that the PSC track and monitor the emerging supply and cost issues associated with that resource. In their comments on the draft SEA, Citizens Utility Board and Clean Wisconsin recommend that the SEA include historic annual average fuel costs for all combustible fuels (including coal) and a projected annual average fuel cost for each year (including coal) for each year during the SEA period. RENEW supports that recommendation.

RENEW appreciates the opportunity to provide the Commission with these comments and recommendations. RENEW continues to believe in the wisdom of comprehensive long range planning of demand, supply and transmission resources to best meet Wisconsin’s electricity needs while balancing cost, reliability, environmental, risk and other factors.

by jboullion | Jan 18, 2011 | Uncategorized

For immediate release:

January 18, 2011

More information

Michael Vickerman

Executive Director

608.255.4044

mvickerman@renewwisconsin.org

Walker’s Wind Siting Proposal Strips Local Control

Mandating by statute an extreme setback distance for commercial wind turbines, Governor Scott Walker’s wind siting proposal would strip local governments of their ability to negotiate lesser setback distances with wind developers, according to RENEW Wisconsin, a statewide renewable energy advocacy group.

Walker’s proposal would require a setback distance between a turbine and neighboring property line of 1,800 feet, which can be shortened only by an agreement between the project owner and owners of adjoining properties, entirely bypassing towns and counties.

Walker’s proposal would eliminate the ability of local governments to attract wind developments that would generate revenues in lieu of taxes to help buffer the expected cuts to local governments in the upcoming state budget.

A story in the Fond du Lac Reporter on January 12 quoted town and county officials as saying the wind project revenue helped save on property taxes by filling the gap between rising municipal expenses and declining state-paid shared revenue dollars.

“We’ve seen five towns in Fond du Lac and Dodge counties enter into joint development agreements specifying reasonable setback distances because town officials wanted to capture the economic benefits of hosting wind projects larger than 50 megawatts,” Vickerman said.

The statewide siting rule, approved by the Public Service Commission (PSC) and set to take effect March 1, preserved local government authority to specify less restrictive conditions.

“This unreasonable proposal is a steamroller driven by anti-wind special interests, like realtors, bent on denying local governments the ability to decide what’s in their best interests,” said Vickerman.

END

by jboullion | Jan 10, 2011 | Uncategorized

For immediate release

January 10, 2011

More information

RENEW Wisconsin

Michael Vickerman

608.255.4044

mvickerman@renewwisconsin.org

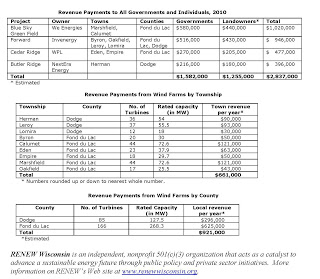

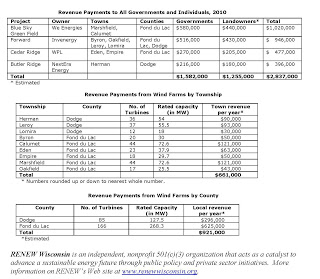

Landowners and Municipalities to Reap Millions from Wind Farm Operations for 2010

Owners of Wisconsin’s four largest wind energy projects will pay out approximately $2.8 million in rent to landowners hosting turbines and payments in lieu of taxes to local governments for 2010, according to figures compiled by RENEW Wisconsin, a statewide renewable energy advocacy organization.

Wind energy developers negotiate lease agreements with landowners to host turbines on their property. Payments can be as high as $7,000 per turbine per year. Estimated rental payments to all Fond du Lac and Dodge county landowners will total slightly more than $1.2 million in 2010.

Towns and counties do not collect property taxes from wind turbines but instead receive payments based on the generating capacity of each turbine, allocated under a formula adopted by the Legislature in 2003. Payments to those local governments will reach almost $1.6 million for 2010.

“These revenues help support farm families and rural Wisconsin communities.” said Michael Vickerman, executive director of RENEW Wisconsin. “It’s a much better deal for the state than sending dollars to Wyoming and West Virginia for the coal imported to Wisconsin to generate electricity.”

Gary Haltaufderheide, an employee of Madison-based Land Services Company, which negotiates land leases for large projects, like pipelines and wind turbines, says, “Farmers are smart business people and they’re very satisfied with the payments. One farmer saw the lease as a way to cover tuition payments for a child entering college.”

Four wind projects – Forward, Blue Sky Green Field, Cedar Ridge, and Butler Ridge – account for the payments to host landowners and local governments. Together these projects comprise nearly 90 percent of Wisconsin’s wind generation fleet.

When calculated over a 20-year contract period, total revenues should exceed $60 million, taking inflation into account.

Shirley Wind, the state’s newest wind power installation, will contributed another $80,000 a year, divided equally between Brown County, Town of Glenmore, local landowners, and neighbors within one-third of a mile of a turbine. The eight-turbine, 20-megawatt project began producing electricity in 2010.

Click tables to enlarge.

by jboullion | Dec 9, 2010 | Uncategorized

FOR IMMEDIATE RELEASE

December 9, 2010

MORE INFORMATION

RENEW Wisconsin

Michael Vickerman

608.255.4044

mvickerman@renewwisconsin.org

Final Wind Siting Rule Improves Clean Energy Outlook

With the changes made at the Public Service Commission’s (PSC) open meeting today, wind developers in Wisconsin can look forward to a set of workable statewide permitting standards that will facilitate the development of well-designed wind projects.

At the meeting, the Commission adjusted the requirements on two issues of critical importance to the wind industry: set back distances and compensation to neighboring residents.

“Today’s decisions culminate a four-year effort to set Wisconsin’s permitting house in order,” said Michael Vickerman, executive director of RENEW Wisconsin, a statewide renewable energy advocacy organization.

“The final rules strike a reasonable balance between protecting public health and safety and advancing wind energy generation, a proven pathway for creating well-paying jobs and increasing revenues to local governments,” Vickerman said.

Initially, the rule did not specify a definite setback distance between turbines and residences and community buildings neighboring the host property.

“By setting a maximum setback distance of 1,250 feet, the rule would not impose economic burdens on wind developers seeking to install newer and larger wind turbines now available in the market, such as the 2.5 megawatt turbines being erected at the Shirley Wind Farm in Brown County,” according to Vickerman.

Regarding compensation to non-participating residences, the commission decided to uncouple the annual compensation level instead of linking the size of the payments to the payment received by the host landowner. The commission’s move resolved the most problematic feature that had been in the rule.

“We thank the Commissioners for their hard work and their willingness to work through a number of very complicated and thorny issues that do not lend themselves to easy resolution,” Vickerman added.

The rules promulgated by the PSC are a product of landmark legislation adopted in 2009 to establish statewide siting standards for wind energy siting. Legislative committees will have 10 days to review the rules after formally receiving them. If they take no action, the rules take effect on January 1, 2011.