by jboullion | Jan 12, 2011 | Uncategorized

From an article by Colleen Kottke in the Fond du Lac Reporter:

Local municipalities are profiting from the wind. While many residents in Fond du Lac and Dodge counties live nowhere near the turbines dotting the landscape, the revenue stream from the towering towers is helping to offset increases in property taxes.

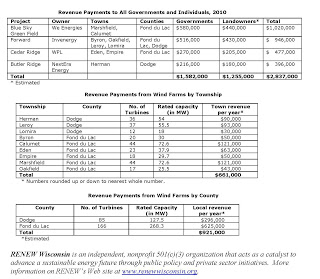

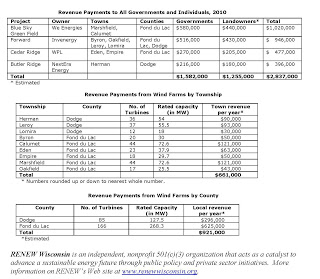

Last year, owners of Wisconsin’s four largest wind energy projects paid out nearly $2.8 million in rent to landowners hosting turbines and payments in lieu of property taxes to local governments, according to figures compiled by RENEW Wisconsin, a statewide renewable energy advocacy organization.

Fond du Lac County, which is home to 166 wind turbines, received a revenue payment of $625,000. Dodge County received $296,000 in payments for hosting 85 wind turbines.

“While we didn’t designate the income for anything in particular, we did use it to pay the bills of the county. Ultimately, it saves on property tax,” said Fond du Lac County Executive Allen Buechel.

Formula

Towns and counties do not collect property taxes from wind turbines but instead receive payments based on the generating capacity of each turbine, allocated under a formula adopted by the state Legislature in 2003.

Of the total revenue paid out to local governmental entities, counties retain two-thirds of the payments while townships hosting the turbines receive one-third. Payments to those local governments in Fond du Lac and Dodge counties will reach almost $1.6 million for 2010.

Wind energy developers negotiate lease agreements with landowners to host turbines on their property. Payments can be as high as $7,000 per turbine each year. Estimated rental payments to all Fond du Lac and Dodge county landowners will total slightly more than $1.2 million for 2010. Property owners hosting the 88 wind turbines in the Blue Sky Green Field wind farm in townships of Marshfield and Calumet divvied up a total of $440,000 paid to them by WeEnergies.

Marshfield Township Chairman John Bord said the $121,000 received from WeEnergies was used to keep rising property taxes in check in the town.

by jboullion | Jan 12, 2011 | Uncategorized

From an article by Colleen Kottke in the Fond du Lac Reporter:

Local municipalities are profiting from the wind. While many residents in Fond du Lac and Dodge counties live nowhere near the turbines dotting the landscape, the revenue stream from the towering towers is helping to offset increases in property taxes.

Last year, owners of Wisconsin’s four largest wind energy projects paid out nearly $2.8 million in rent to landowners hosting turbines and payments in lieu of property taxes to local governments, according to figures compiled by RENEW Wisconsin, a statewide renewable energy advocacy organization.

Fond du Lac County, which is home to 166 wind turbines, received a revenue payment of $625,000. Dodge County received $296,000 in payments for hosting 85 wind turbines.

“While we didn’t designate the income for anything in particular, we did use it to pay the bills of the county. Ultimately, it saves on property tax,” said Fond du Lac County Executive Allen Buechel.

Formula

Towns and counties do not collect property taxes from wind turbines but instead receive payments based on the generating capacity of each turbine, allocated under a formula adopted by the state Legislature in 2003.

Of the total revenue paid out to local governmental entities, counties retain two-thirds of the payments while townships hosting the turbines receive one-third. Payments to those local governments in Fond du Lac and Dodge counties will reach almost $1.6 million for 2010.

Wind energy developers negotiate lease agreements with landowners to host turbines on their property. Payments can be as high as $7,000 per turbine each year. Estimated rental payments to all Fond du Lac and Dodge county landowners will total slightly more than $1.2 million for 2010. Property owners hosting the 88 wind turbines in the Blue Sky Green Field wind farm in townships of Marshfield and Calumet divvied up a total of $440,000 paid to them by WeEnergies.

Marshfield Township Chairman John Bord said the $121,000 received from WeEnergies was used to keep rising property taxes in check in the town.

by jboullion | Jan 12, 2011 | Uncategorized

From an article by Colleen Kottke in the Fond du Lac Reporter:

Local municipalities are profiting from the wind. While many residents in Fond du Lac and Dodge counties live nowhere near the turbines dotting the landscape, the revenue stream from the towering towers is helping to offset increases in property taxes.

Last year, owners of Wisconsin’s four largest wind energy projects paid out nearly $2.8 million in rent to landowners hosting turbines and payments in lieu of property taxes to local governments, according to figures compiled by RENEW Wisconsin, a statewide renewable energy advocacy organization.

Fond du Lac County, which is home to 166 wind turbines, received a revenue payment of $625,000. Dodge County received $296,000 in payments for hosting 85 wind turbines.

“While we didn’t designate the income for anything in particular, we did use it to pay the bills of the county. Ultimately, it saves on property tax,” said Fond du Lac County Executive Allen Buechel.

Formula

Towns and counties do not collect property taxes from wind turbines but instead receive payments based on the generating capacity of each turbine, allocated under a formula adopted by the state Legislature in 2003.

Of the total revenue paid out to local governmental entities, counties retain two-thirds of the payments while townships hosting the turbines receive one-third. Payments to those local governments in Fond du Lac and Dodge counties will reach almost $1.6 million for 2010.

Wind energy developers negotiate lease agreements with landowners to host turbines on their property. Payments can be as high as $7,000 per turbine each year. Estimated rental payments to all Fond du Lac and Dodge county landowners will total slightly more than $1.2 million for 2010. Property owners hosting the 88 wind turbines in the Blue Sky Green Field wind farm in townships of Marshfield and Calumet divvied up a total of $440,000 paid to them by WeEnergies.

Marshfield Township Chairman John Bord said the $121,000 received from WeEnergies was used to keep rising property taxes in check in the town.

by jboullion | Jan 11, 2011 | Uncategorized

From an editorial in the Milwaukee Journal Sentinel:

Wind turbines on the lakefront would be a good sign for the city’s renewable energy portfolio.

Milwaukee’s lakefront may in some ways indeed be sacred to local residents. Its natural beauty is a defining characteristic of the city and the region. But it is not so sacred that worthwhile projects can’t be developed for the lakefront.

One such project that deserves serious consideration is placing one to three wind turbines near the Lake Express car ferry terminal to provide renewable power for the Port of Milwaukee administration. It also is designed to demonstrate the city’s commitment renewable energy. These are all good things.

The project would be funded with a block grant from federal economic stimulus dollars, Erick Shambarger, a city environmental sustainability manager, told Journal Sentinel reporter Thomas Content. “No property tax dollars would be involved,” Shambarger said.

Most of the $5.8 million block grant would go to programs aimed at boosting energy efficiency and conservation, but city officials saw the wind turbine project as an opportunity “to show the city’s commitment to renewable power. Having this at the port building would be a visible way to do that,” Shambarger said.

The cost of the project would depend on the type of turbine selected. A larger turbine is expected to cost $550,000, but the price could be reduced by incentives that the city would seek from the Focus on Energy program and We Energies.

by jboullion | Jan 10, 2011 | Uncategorized

For immediate release

January 10, 2011

More information

RENEW Wisconsin

Michael Vickerman

608.255.4044

mvickerman@renewwisconsin.org

Landowners and Municipalities to Reap Millions from Wind Farm Operations for 2010

Owners of Wisconsin’s four largest wind energy projects will pay out approximately $2.8 million in rent to landowners hosting turbines and payments in lieu of taxes to local governments for 2010, according to figures compiled by RENEW Wisconsin, a statewide renewable energy advocacy organization.

Wind energy developers negotiate lease agreements with landowners to host turbines on their property. Payments can be as high as $7,000 per turbine per year. Estimated rental payments to all Fond du Lac and Dodge county landowners will total slightly more than $1.2 million in 2010.

Towns and counties do not collect property taxes from wind turbines but instead receive payments based on the generating capacity of each turbine, allocated under a formula adopted by the Legislature in 2003. Payments to those local governments will reach almost $1.6 million for 2010.

“These revenues help support farm families and rural Wisconsin communities.” said Michael Vickerman, executive director of RENEW Wisconsin. “It’s a much better deal for the state than sending dollars to Wyoming and West Virginia for the coal imported to Wisconsin to generate electricity.”

Gary Haltaufderheide, an employee of Madison-based Land Services Company, which negotiates land leases for large projects, like pipelines and wind turbines, says, “Farmers are smart business people and they’re very satisfied with the payments. One farmer saw the lease as a way to cover tuition payments for a child entering college.”

Four wind projects – Forward, Blue Sky Green Field, Cedar Ridge, and Butler Ridge – account for the payments to host landowners and local governments. Together these projects comprise nearly 90 percent of Wisconsin’s wind generation fleet.

When calculated over a 20-year contract period, total revenues should exceed $60 million, taking inflation into account.

Shirley Wind, the state’s newest wind power installation, will contributed another $80,000 a year, divided equally between Brown County, Town of Glenmore, local landowners, and neighbors within one-third of a mile of a turbine. The eight-turbine, 20-megawatt project began producing electricity in 2010.

Click tables to enlarge.