The transition to a clean and renewable economy includes many paths from all the economic sectors. Some of the transition decisions are made by government, some by business and NGOs, and some by individuals. When it comes to individuals, there are multiple options, such as where we live, our homes and how we live in them, what we eat, what we throw away, and how we travel, to name a few.

When it comes to getting around, the options are varied: walking, biking, ride-sharing, using public transportation, and driving a car, whether gas or electric. In most cases, it’s a combination of these options.

As a self-proclaimed energy geek, I take pride in regularly assessing my energy footprint. I’ve been doing this since the first Earth Day in 1970 when I was a junior in college (yes, I’m dating myself!). I’ve also been labeled as “frugal” by my friends and acquaintances, an apt label considering I still have some shirts from the 1970s. Both my educational training and work in the clean energy space over 40-plus years allow me to tackle both energy and financial impacts systematically.

As a self-proclaimed energy geek, I take pride in regularly assessing my energy footprint. I’ve been doing this since the first Earth Day in 1970 when I was a junior in college (yes, I’m dating myself!). I’ve also been labeled as “frugal” by my friends and acquaintances, an apt label considering I still have some shirts from the 1970s. Both my educational training and work in the clean energy space over 40-plus years allow me to tackle both energy and financial impacts systematically.

This particular skill set came in handy when my 2010 Toyota Prius, with 135,000 miles, started to show signs of age and expense. It was time to use my energy assessment tools and frugal habits to select the best vehicle that fit my values. For me, the decision was based on current and future driving patterns, energy and environmental impact, and price ( incentives included).

I walk or bike for most of my short trips in Madison, WI, that are 5 miles or less. My partner of eight years lives almost 10 miles away, and I usually drive to her place three or four times each week. We are both retired and go on occasional daily or weekly road trips that can be hundreds of miles away.

The Inflation Reduction Act now offers up to $4,000 tax credit for qualified used plug-in hybrid electric vehicles that are at least two years old, are purchased after December 31, 2022, from a certified car dealer, cost less than $25,000, and have 7 KW or higher battery storage. To be eligible for the tax credit, an individual must have an Adjusted Gross Income of $75,000 or less and $150,000 or less for married couples for the current or previous tax year.

So, for me, the goal was to find a plug-in electric hybrid that delivered at least 25 miles on electric power, got good gas mileage, had less than 50,000 miles on the odometer, and would qualify for the federal tax credit.

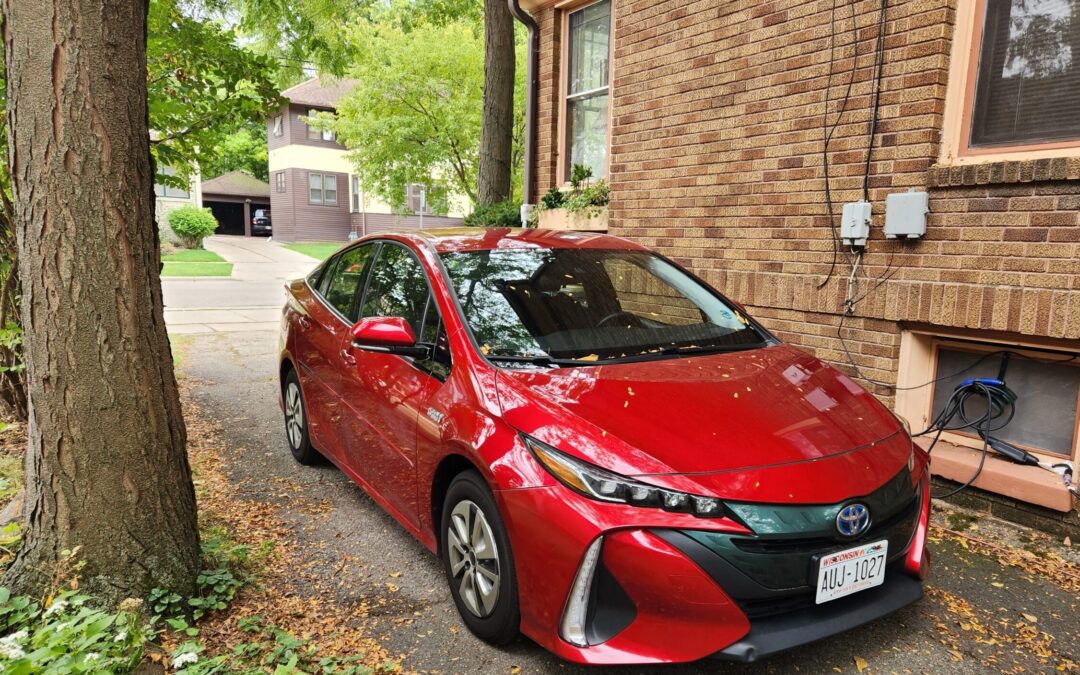

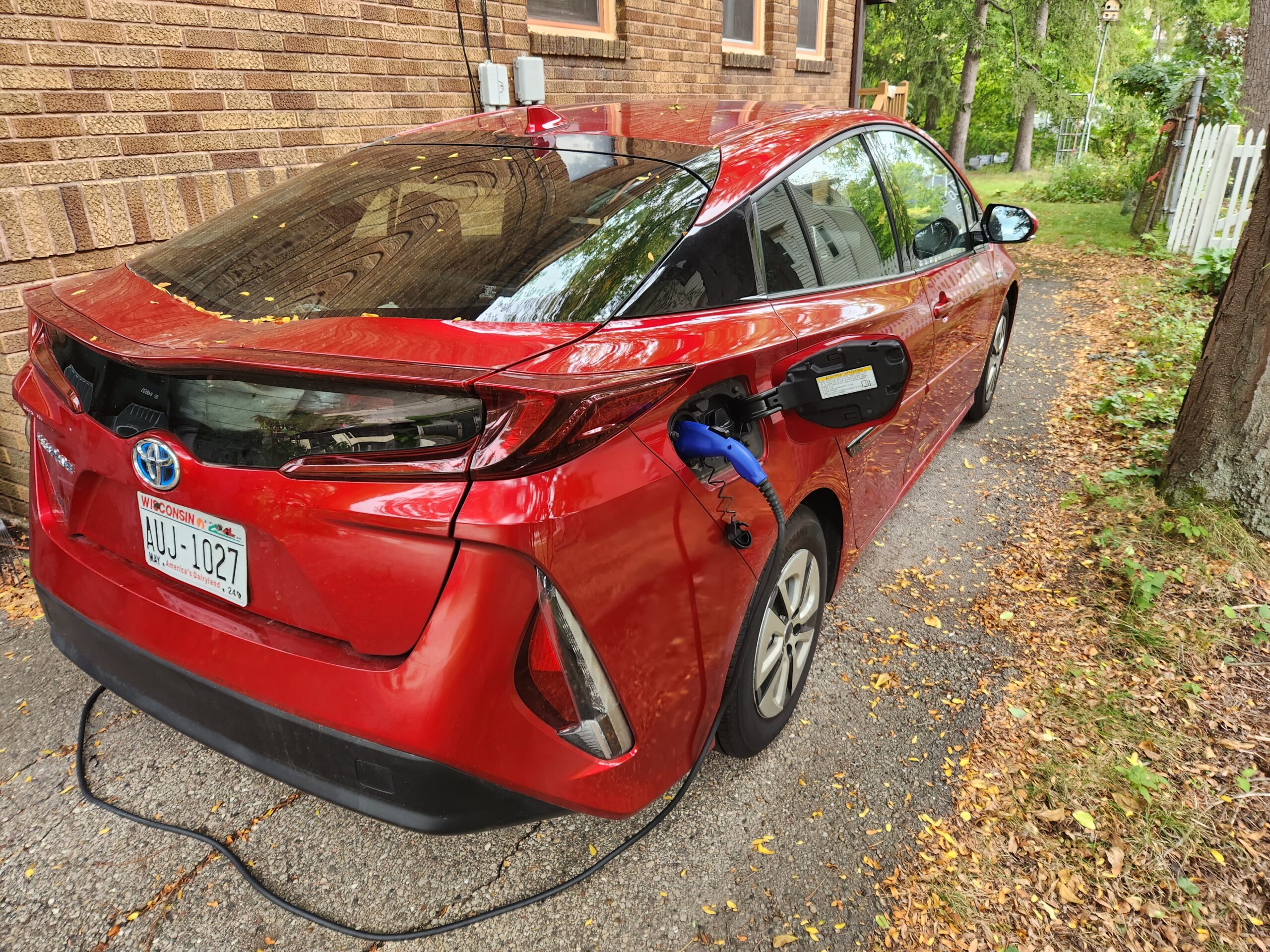

The most likely candidates to fit these requirements were the Toyota Prius Prime, the Hyundai Ionic, and the Kia Niro. All three could be charged overnight using a standard 120-volt outlet, which I had next to my driveway. There are pros and cons for each of these, based on personal preferences and price. In total, my search lasted about six months.

The most likely candidates to fit these requirements were the Toyota Prius Prime, the Hyundai Ionic, and the Kia Niro. All three could be charged overnight using a standard 120-volt outlet, which I had next to my driveway. There are pros and cons for each of these, based on personal preferences and price. In total, my search lasted about six months.

Major online car retailers, like Carfax and Autotrader, helped to determine what was available within a reasonable distance from Madison. Unfortunately, I was unable to find eligible vehicles in the immediate Madison area during this time period. Locating an eligible vehicle for less than $25,000 was also a major limiting variable.

Eventually, I found and purchased a 2018 Toyota Prius Prime from a car dealership in Eau Claire, WI, that met my requirements. After almost three months of charging and driving, I’m pleased with my purchase. The car has been delivering a pretty standard 30-31 miles on pure electric power in town, and 54 to 58 miles per gallon.

After about 2,000 miles I’ve used just 15 gallons of gas. Depending on my final tax status, I’ll have a highly energy-efficient and environmentally friendly vehicle for about $20,000. This definitely meets my energy and frugality goals. I credit the Inflation Reduction Act as key in focusing my attention on a vehicle that allowed me to fulfill my goals.

– Don Wichert

Emeritus Board Member and Founder of RENEW Wisconsin